virginia estimated tax payments corporate

The safe harbors for corporate estimated tax are both 100. Who Must Pay Estimated Tax.

Treasurers Association Of Virginia Virginia Department Of Taxation 1 Local Estimated Tax Payments Howard Overbey Tax Processing Manager June 23 Ppt Download

If you are required to file a tax return and your Virginia income tax liability after subtracting income tax withheld and any allowable credits is expected to be more than 150 then you.

. Code 1950 58-15139. Use the appropriate mailing address below when mailing your payment. Check the sections youd like to appear in the report then use.

Make tax due estimated tax and extension payments Business Taxes Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous. Every corporation required by this article to file a declaration of estimated income tax shall file the same with and make payment to the Department. File your West Virginia CIT-120 electronically.

If you are unable to file by such due dates. Payment Fee - Returned Payments If your financial institution does not honor your payment to us we may impose a. Fiduciary and Individual filers who meet these criteria are required to file electronically.

Attach to your West Virginia Corporate. Failure to pay estimated tax. Penalties for Late Filing and Late Payment Extension penalty Applies if at least 90 of the withholding tax due isnt.

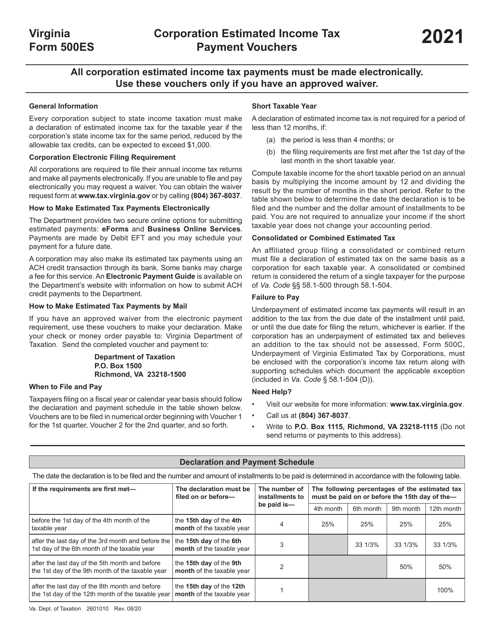

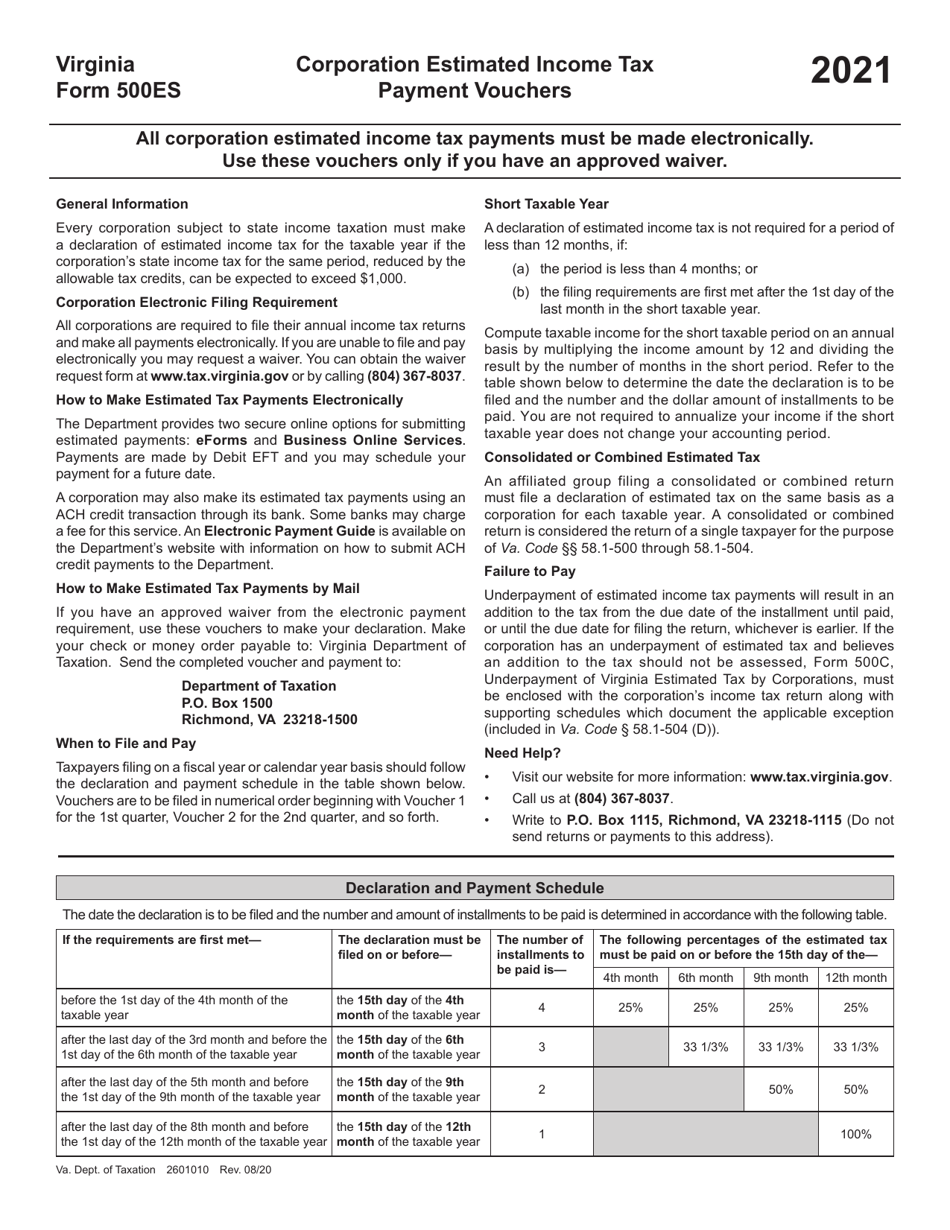

500ES 500ES For Period Filing Basis Calendar Fiscal Short For Taxable Year Ending Account Number 35- FEIN F- Account Suffix Demographics Name of Corporation Mailing Address City. 770ES For Period Filing Basis Calendar Fiscal For Taxable Year Estate Trust Form 765 Unified Nonresident Account Number 32- FEIN F-001 Demographics Name of Estate Trust or Unified. Estimated tax payment due dates in 2022 and 2023 Virginia estimated tax payments are due in four quarterly amounts.

The following four filing deadlines apply to every. Use electronic funds transfer to make installment payments of estimated tax. Use Form 1120-W Estimated Tax for Corporations as a worksheet to calculate your estimated.

Pursuant to 581-4003 of the Code of Virginia certain electric suppliers are required to pay a minimum tax rather than a corporate income tax for any taxable year their minimum tax. Corporate estimated tax payments safe harbor. On or before May 1 June 15 September 15 and the following year on January 15.

Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to. Corporation Income Tax 23VAC10-120-460. Any installment payment of estimated tax exceeds 1500 or Any payment made for an extension.

760ES For Taxable Year For Taxable Year Demographics Your Social Security Number SSN First Name MI Last Name Spouses SSN If Filing a Joint Return First Name MI Last Name. Use the same taxable year and method of accounting as you use for Federal Tax Purposes. Use Form 502W to make the withholding tax payment by the due date.

For Virginia estimated tax payments are due in equal installments four times a year.

West Virginia Form It140es It 140es Individual Estimated Income Tax Payment 2021 West Virginia Taxformfinder

Clean Virginia The Dominion Tax

Form 500es Download Fillable Pdf Or Fill Online Corporation Estimated Income Tax Payment Vouchers 2021 Virginia Templateroller

The Corporate Minimum Tax Could Hit These Ultra Profitable Companies The Washington Post

Form 500es Download Fillable Pdf Or Fill Online Corporation Estimated Income Tax Payment Vouchers 2021 Virginia Templateroller

Form Spf 100 Es Estimated Income Business Franchise Tax Payment For S Corporation And Partnership

Instructions For Making Estimated Tax Payments State Of West Virginia

Virginia Department Of Taxation Virginia Tax Reminder Individual Estimated Tax Payments Are Due On June 15 More Info Https Www Tax Virginia Gov Individual Estimated Tax Payments Facebook

Virginia Estimated Taxes For Small Businesses 2022 Guide

Strategies For Minimizing Estimated Tax Payments

Virginia Begins Requiring Electronic Payment For Certain Individual Taxpayers Miles Stockbridge P C Jdsupra

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Form 770es Fillable 770es Virginia Estimated Income Tax Payment Vouchers For Estates Trusts And Unified Nonresidents

Corporate Tax In The United States Wikipedia

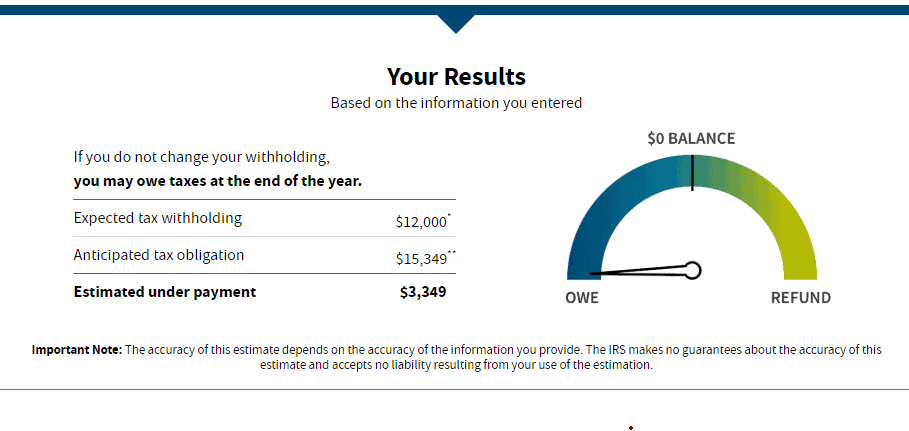

Tax Withholding Estimator Shortcomings Virginia Cpa

Virginia State Income Tax Rates And Who Pays In 2022 Nerdwallet